USAA to Offer Financial Assistance for Members Impacted by a Potential Government Shutdown

If a shutdown occurs, eligible members can apply for a no-interest loan and explore various payment relief options via USAA.com or the USAA app

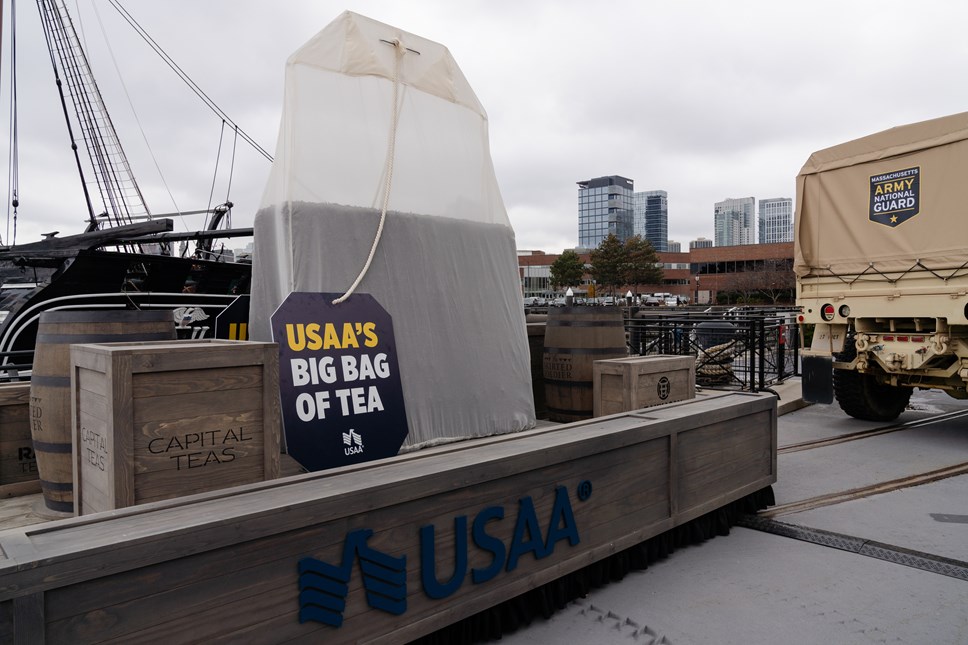

Steeped in Tradition: USAA Kicks Off 124th Army-Navy Game Celebrations in a Massive Way, Honoring 250th Anniversary of the Boston Tea Party

USAA honors history of rivalry game and the city, bringing giant bag of tea to Boston’s historic sites

“Go Beyond Thanks:” New Survey Reveals We Should Do More Than Simply Thank Our Veterans for Their Service

Data Reveals Half of Military/Veterans Surveyed Feel Uncomfortable or Awkward When Someone Says the Phrase “Thank You for Your Service” to Them, Increasing to Nearly 70% Amongst Younger Veterans

Face the Fight™ Coalition Expands to More Than 50 Members, Funds Next Round of Grants Supporting Veteran Suicide Prevention

USAA-led initiative, with founding partners the Humana Foundation and Reach Resilience, gains steam to increase awareness of national crisis

USAA Federal Savings Bank Tops 2023 American Banker/RepTrak Bank Reputation Survey

Bank named ‘most reputable’ by members and non-members for the seventh consecutive year

Face The Fight

Learn how USAA is responding to make a difference so that those who have defended our freedom have the resources they need to win the fight against veteran suicide.

Corporate Responsibility

We serve military families and strengthen local communities through philanthropic grantmaking, employee giving and volunteer work.

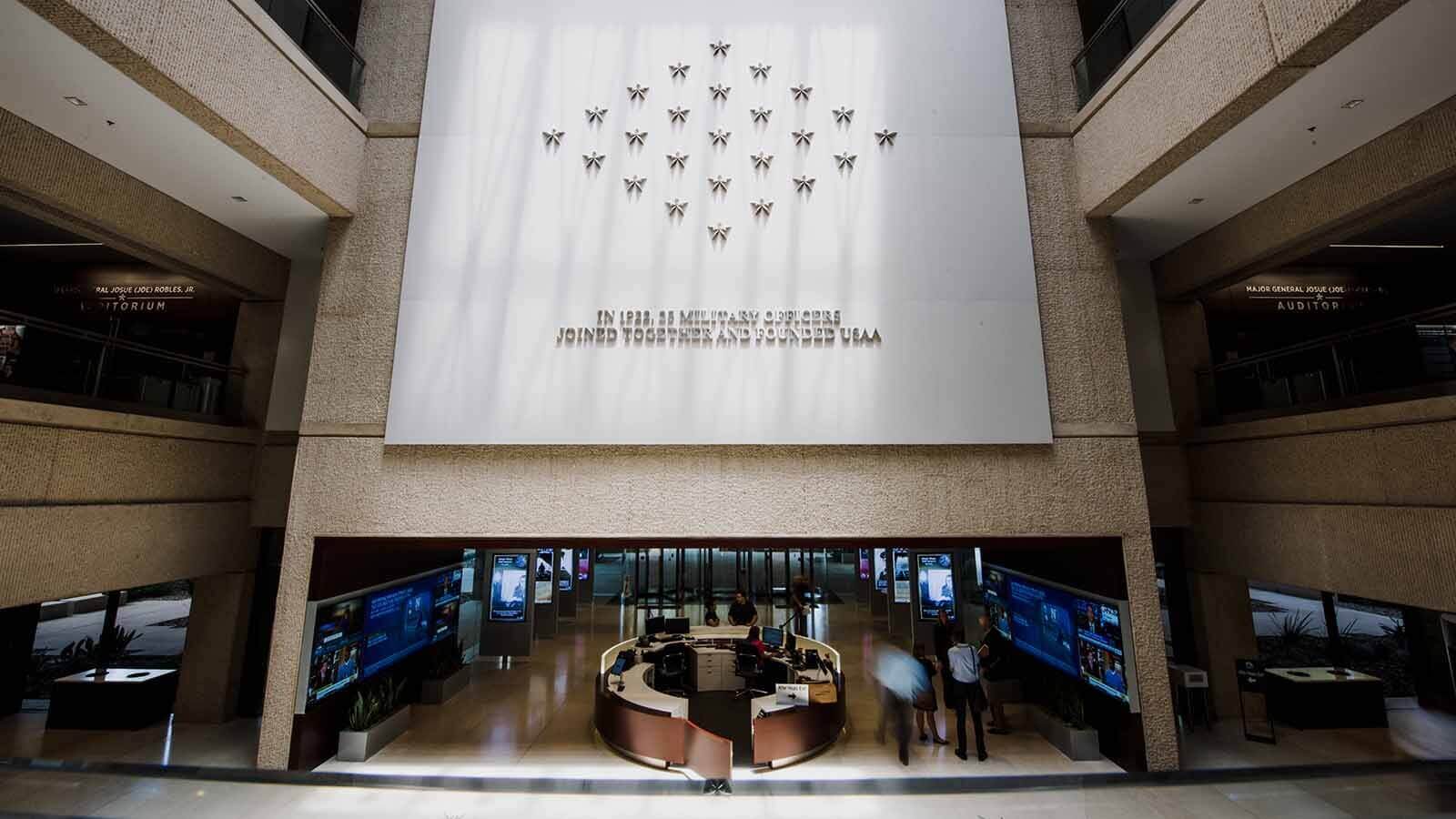

Our Operating Companies

USAA is among the leading providers of insurance, banking, investment and retirement solutions to members of the U.S. military, veterans who have honorably served and their families.

USAA Leadership Team

Strong leadership is key to fulfilling our mission. Meet the people who lead us in going above for those who have gone beyond.

Latest news

Former Army Maj. Gen. John B. Richardson IV Joins USAA To Lead Military Affairs

Two-star general and decorated combat veteran to bring forward-looking vision in continued service to military members and their families.

USAA to Offer Financial Assistance for Members Impacted by a Potential Government Shutdown

If a shutdown occurs, eligible members can apply for a no-interest loan and explore various payment relief options via USAA.com or the USAA app

Steeped in Tradition: USAA Kicks Off 124th Army-Navy Game Celebrations in a Massive Way, Honoring 250th Anniversary of the Boston Tea Party

USAA honors history of rivalry game and the city, bringing giant bag of tea to Boston’s historic sites